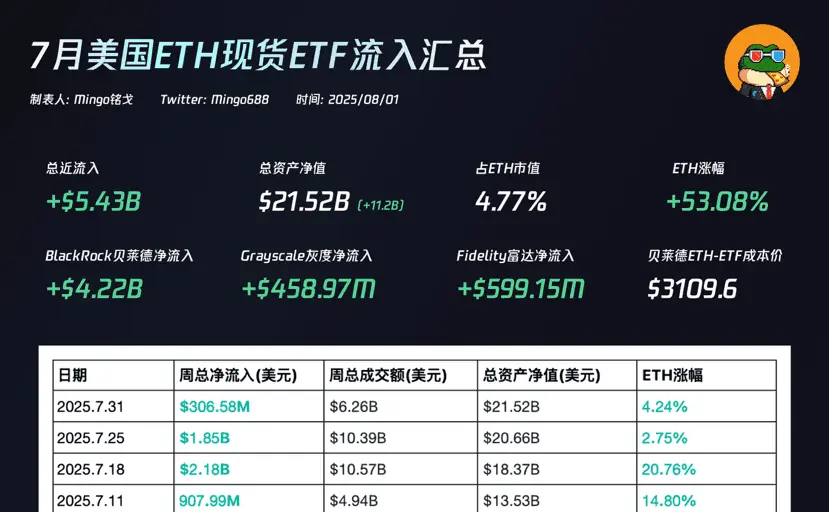

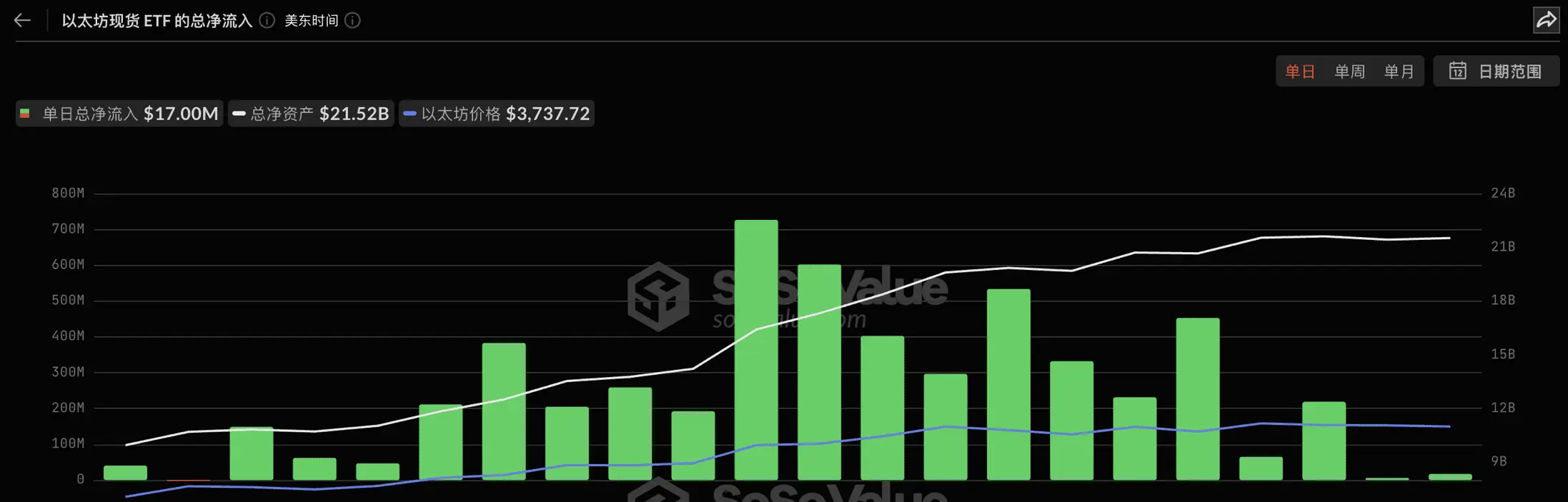

Recently, the Ethereum (ETH) market has seen a striking trend: traditional enterprises are significantly increasing their holdings of ETH, while encryption projects are gradually reducing their ETH reserves. This shift in the flow of funds may signal a significant transformation in the market landscape.

Several traditional companies have shown a strong interest in ETH. Bitmine invested $218 million to purchase ETH, followed closely by SharpLink with an investment of $290 million. The Ether Machine entered the market with an astonishing investment of $627 million. Additionally, new players ETHZ

Several traditional companies have shown a strong interest in ETH. Bitmine invested $218 million to purchase ETH, followed closely by SharpLink with an investment of $290 million. The Ether Machine entered the market with an astonishing investment of $627 million. Additionally, new players ETHZ

ETH-2.88%