IntoTheBlock

No content yet

IntoTheBlock

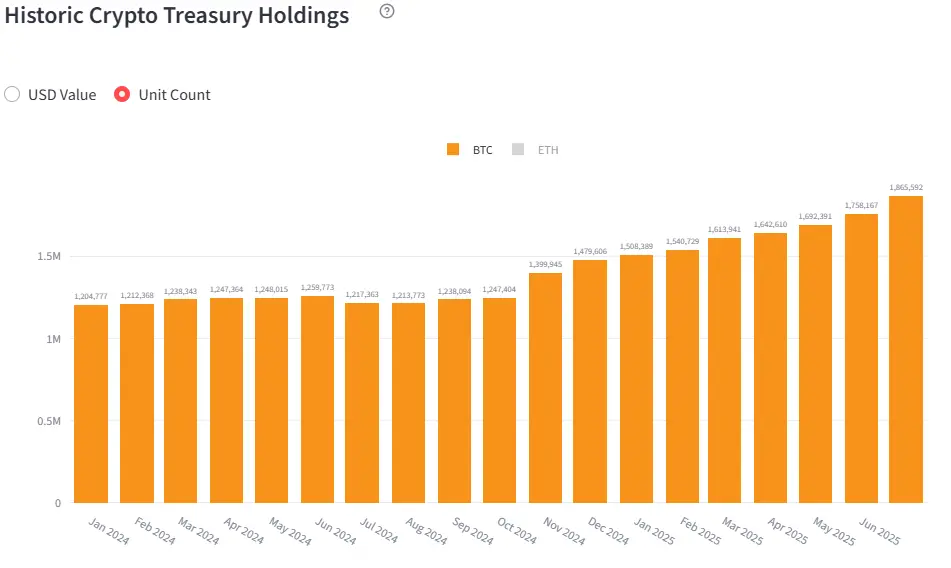

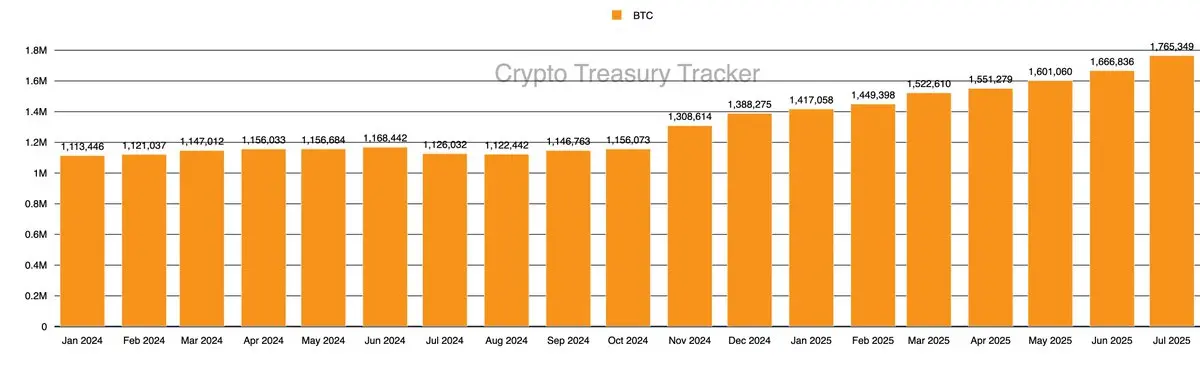

This chart shows how Bitcoin treasuries have grown over time👇

Download our deepdive report here: 🔗

Download our deepdive report here: 🔗

BTC-2.47%

- Reward

- like

- Comment

- Repost

- Share

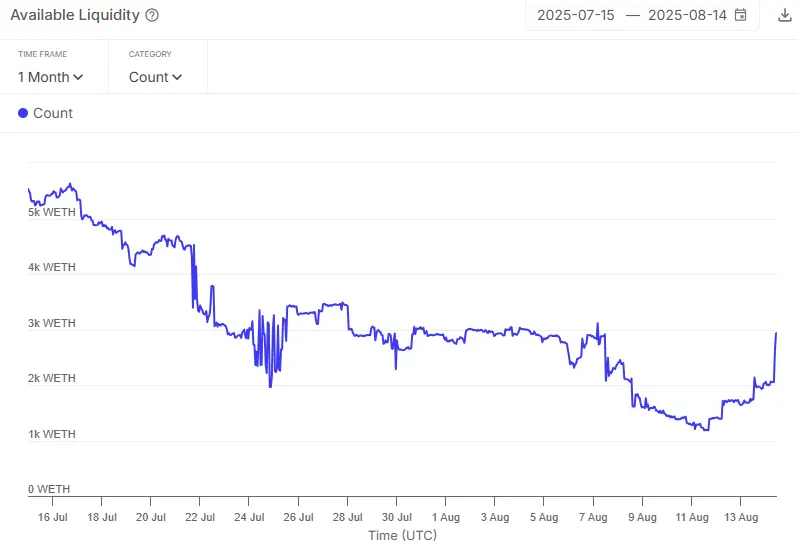

Liquidity Alert: Available WETH liquidity on @MoonwellDeFi increased by $3,167,608.84 (+33.5%) in the last 24 hours

🔗

🔗

IN-14.32%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Bitcoin long-term holder balances have fallen to cycle lows, suggesting that hodlers are selling as prices rise. While this behavior is typical in bull markets, the process is unfolding more gradually than in past cycles.

Is this be a sign that the traditional 4-year cycle is shifting?

Is this be a sign that the traditional 4-year cycle is shifting?

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Are you on top of all key DeFi risks?

📅Wednesday Aug 13

Register to join us live👇

📅Wednesday Aug 13

Register to join us live👇

DEFI-3.01%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Join us live on Wednesday to discuss the current DeFi landscape and key risks to consider. Our VP of institutional DeFi, Lucas Outumuro, will dive into recent risk events and important indicators to watch.

DEFI-3.01%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

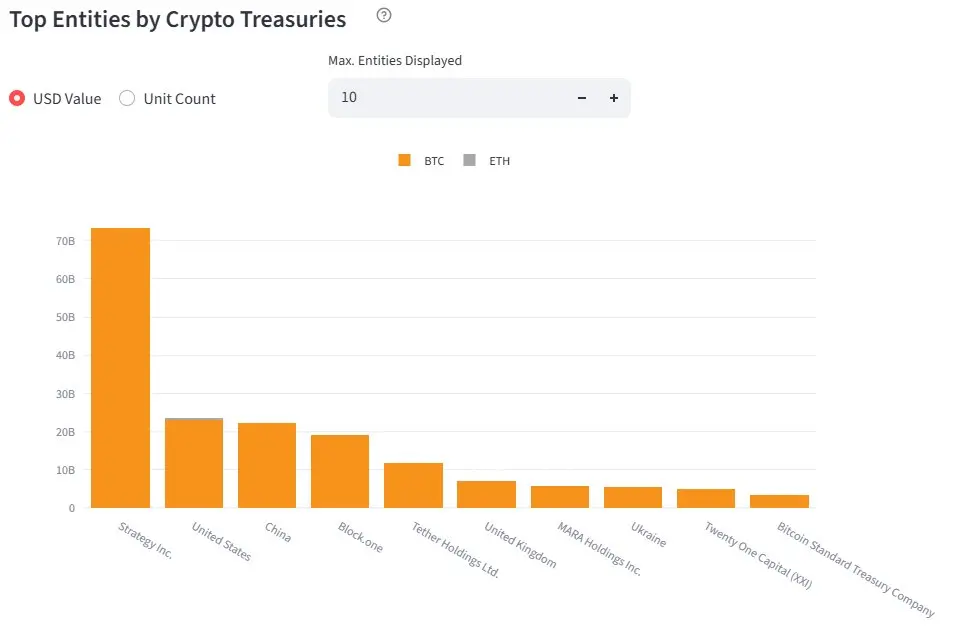

This chart highlights the top 10 governments and companies by Bitcoin holdings.

What key insights do you notice?

What key insights do you notice?

BTC-2.47%

- Reward

- like

- Comment

- Repost

- Share

In this week's newsletter we dive into the regulatory shift toward regulated spot-crypto trading on U.S. futures exchanges👇

IN-14.32%

- Reward

- 1

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share